SWINGALGO+ WEEKLY BIAS presents

a simple wealth building strategy that anyone can do (and should start) immediately

There are many ways to utilize the accuracy of Weekly Bias.

I want to eventually go over everything but I have no doubt that you will also discover some amazing things about Weekly Bias doing your own diligence.

I did want to point you in the direction of a “long term wealth building strategy” that I truly believe everyone should know/currently be building.

Do this for your family. Do this for your kids. Do this for your future. In the book ‘7 Habits of Highly Effective People’, author Steven Covey suggests that all successful people share the concept building passive income. Begin the process of building wealth while you sleep.

Take cash and invest that cash into cash producing assets. Start this process ASAP. Your future self will thank you.

Okay, let’s jump in.

EVERYTHING YOU (BRIEFLY) NEED TO KNOW ABOUT DIVIDEND STOCKS

A dividend stock is a share in a company that pays regular cash distributions, called dividends, to its shareholders. These payments come from the company's profits.

Key points:

Dividends: Regular cash payments from the company to shareholders.

Income: Investors receive income from owning the stock, typically quarterly (can be reinvested*).

Stable Companies: Usually, dividend stocks are from well-established companies with steady profits.

Yield: The dividend yield is the annual dividend payment divided by the stock's price, showing the return on investment from dividends alone.

Growth: While dividend stocks provide income, they might not grow as fast as non-dividend stocks in terms of share price.

So, a dividend stock gives you a combination of potential stock price appreciation and regular income.

TL;DR version: A dividend stock is a share in a company that regularly pays cash to its shareholders from its profits, providing steady income and potential for price growth.

**If you want to do your due diligence on pairing dividend yields with other fundamental forces, you can start here:

Dividend Payout Ratio: This is the percentage of earnings paid out as dividends. A lower ratio suggests the dividend is more sustainable.

Earnings Growth: Look for companies with consistent earnings growth, indicating they can maintain or increase dividends over time.

Free Cash Flow: This measures the cash a company generates after capital expenditures. Positive and growing free cash flow supports dividend payments.

Debt Levels: Companies with manageable debt are less likely to cut dividends during downturns. Check the debt-to-equity ratio.

Dividend History: Companies with a long history of paying and increasing dividends are often more reliable.

Profitability Ratios: Metrics like Return on Equity (ROE) and Return on Assets (ROA) can indicate efficient management and profitability, supporting sustainable dividends.

By combining dividend yield with these fundamental market forces, you can better assess the quality and sustainability of a company's dividend payments.**

THE IMPORTANT PART:

Simply put, you can accumulate shares in a company that pay out dividends and reinvest those dividends to buy more shares.

This emoji, basically: 🔂

This repeatable process allows you to benefit from compounding interest, as your investment grows not only from the stock's value but also from the reinvested dividends, leading to exponential growth over time.

Please allow me to geek out on compounding interest for a minute.

Compounding interest is the process where the value of an investment grows because the earned interest or returns are reinvested to generate additional earnings over time. This means you earn interest on both your initial principal and the accumulated interest from previous periods, leading to exponential growth. The formula for compound interest is:

where:

A is the amount of money accumulated after n periods, including interest.

P is the principal amount (the initial sum of money).

r is the annual interest rate (decimal).

n is the number of times interest is compounded per year.

t is the time the money is invested for, in years.

“The most powerful force in the universe is compound interest.”-Warren Buffet

“The first rule of compounding is to never interrupt it unnecessarily.”-Charlie Munger

Generational wealth is built on the concept of compounding interest. Spend some time learning about it. It will be well worth your time, I promise.

THE MOST IMPORTANT PART: WEEKLY BIAS

By employing Weekly Bias H- Event Alerts to initiate hedging strategies, such as selling call options or buying put options (your easiest and most likely choice), investors can mitigate downside risk in their dividend stock positions.

The cash generated from these hedging activities can then be reinvested to purchase additional shares of the dividend stock.

This approach not only protects the existing investment but also harnesses market fluctuations to accumulate more shares, thereby amplifying the compounding effect and enhancing long-term portfolio growth.

Matthew, this is information overload, what are you saying?

I am saying this:

Dividend Reinvestment: Automatically reinvesting dividends to purchase additional shares of the dividend stock, thereby increasing the principal amount and future dividend payouts.

Hedging with Weekly Bias H- Event Alerts: Utilizing H- Event Alerts to engage in hedging activities, such as selling call options or buying put options, to protect against downside risk.

Reinvesting Profits from Hedging: Redirecting the profits from these hedging activities back into the purchase of additional shares of the dividend stock.

This approach effectively layers the compounding effect through three channels:

Regular dividend reinvestment,

Hedging profits reinvestment, and

Continued accumulation of shares from the initial principal.

As a result, investors can achieve an exponential growth in their investment portfolio, maximizing returns through a disciplined and systematic application of compounding principles.

To wrap this up, let’s take a look at my favorite ticker to do that with the stock ticker $MAIN

**This ticker is not a recommendation. Apply Weekly Bias to any/all dividend stocks and do your due diligence**

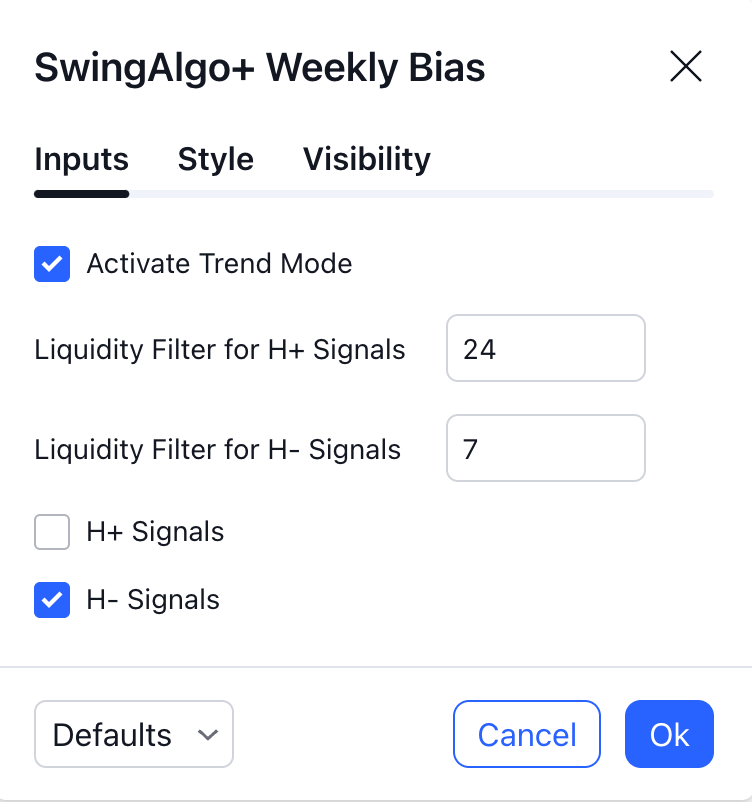

As you can see, with Weekly Bias H- Event Alerts configured to these settings…

Weekly Bias produced 12 out of 13(!) successful H- Event Alerts that preceded moves down.

*12 opportunities to hedge your dividend position and reinvest that cash back into accumulating more shares.

*You can even turn H+ Event Alerts on and Dollar Cost Average your share position at those events. Protip: waiting for BIG market pull backs is the most cost effective way to do this.

APPLICATION AND REVIEW

APPLICATION:

Set an H- Event Alert on your dividend tickers chart

Show up to the H- Event Alert and execute your Bought Put or Sold Call* position.

Manage Risk and/or take profits according to your personal risk management parameters

(**There are other advanced hedging strategies that are beyond the scope of this post. I encourage you to learn them as well, but I recommend starting with bought Puts**)

Use SwingAlgo+ Weekly Bias to tell you exactly when to do that. Weekly Bias is your market companion, guiding you as you build your financial future.

REVIEW:

Dividend Reinvestment: Automatically reinvesting dividends to purchase additional shares of the dividend stock, thereby increasing the principal amount and future dividend payouts.

Hedging with Weekly Bias H- Event Alerts: Utilizing H- Event Alerts to engage in hedging activities, such as selling call options or buying put options, to protect against downside risk.

Reinvesting Profits from Hedging: Redirecting the profits from these hedging activities back into the purchase of additional shares of the dividend stock.

This approach effectively layers the compounding effect through three channels:

Regular dividend reinvestment

Hedging profits reinvestment

Continued accumulation of shares from the initial principal

You can apply this concept to your IRA’s. Protect your downside with Weekly Bias H- Event Alerts.

SwingAlgo+ Weekly Bias can guide you to achieve exponential growth in your investment portfolio, maximizing returns through a disciplined and systematic application of compounding principles.

-Matthew

Get Weekly Bias here: SwingAlgo+ Weekly Bias

Learn more about Weekly Bias here: Everything You Need to Know About Weekly Bias